Online Loan Calculator – Calculate Monthly Payments Easily

Regular Payment

–

Loan Duration

–

Total Interest

–

Looking for a quick and easy way to calculate your monthly loan payments? Our online loan calculator is designed to help individuals, students, business owners, and anyone planning to take a loan understand their borrowing costs accurately. Just enter your loan amount, interest rate, and loan term, and get instant results.

Whether you’re planning a personal loan, car loan, or mortgage, this tool makes complex calculations simple, helping you save time, avoid errors, and make informed decisions—all in seconds.

What is a Loan Calculator?

A loan calculator is a financial tool that helps you determine your monthly repayment amount, total interest, and overall loan duration based on specific inputs such as the loan amount, annual interest rate, and repayment period.

For example, if you borrow $10,000 at a 5% interest rate for 5 years, the calculator will show how much you’ll pay monthly and how much interest you’ll end up paying over time.

Basic formula used:

📌 EMI = [P × r × (1 + r)ⁿ] / [(1 + r)ⁿ – 1]

Where:

P = Loan Amount

r = Monthly Interest Rate

n = Total Number of Payments

How to Use the Loan Calculator (Step-by-Step)

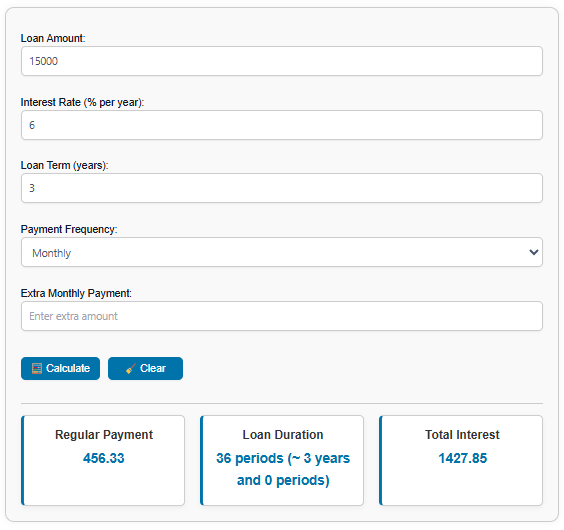

Enter your loan amount – e.g., $15,000

Input the interest rate (annual percentage) – e.g., 6%

Choose your loan term in years – e.g., 3 years

Select payment frequency – Monthly, Quarterly, etc.

Add any extra monthly payment (optional)

Click Calculate – your results appear instantly!

Use the Clear button to start over anytime

🔍 No more manual math or spreadsheets – just quick, accurate results!

Tool Features

Fast, Accurate Calculations

Get real-time loan estimates in seconds with precision and clarity.Flexible Payment Frequency

Choose between monthly, quarterly, or annual payments based on your plan.Optional Extra Payments

See how paying a little more each month can reduce your total interest.Amortization Included

Understand how each payment is split between principal and interest over time.100% Private – No Data Stored

All calculations happen in your browser. Your financial data is never saved or sent anywhere.

Use Cases / Benefits

Imagine you’re budgeting for a car or considering a student loan—this tool helps you understand how much you’ll pay. It’s ideal for:

🧑🎓 Students planning education loans

👨👩👧👦 Families managing home renovation budgets

💼 Freelancers & Business Owners projecting loan costs

🚗 Car buyers estimating auto loan affordability

No more surprises. You’ll know exactly how much your loan will cost, so you can plan with confidence.

Formula & Calculation Logic

Monthly Payment Formula:

📘 EMI = [P × r × (1 + r)^n] ÷ [(1 + r)^n – 1]

Example:

Loan Amount (P): $10,000

Annual Interest Rate: 6% → Monthly = 0.5% (0.005)

Term: 3 years → 36 months

Calculation:

EMI = [$10,000 × 0.005 × (1+0.005)^36] ÷ [(1+0.005)^36 – 1]

→ Monthly Payment ≈ $304.22

📊 This ensures full transparency and accuracy for your budgeting.

FAQs

Can I use this for any type of loan?

Yes! Whether it’s a car loan, personal loan, or mortgage, the calculator gives accurate estimates for any type.

Does it account for extra monthly payments?

Absolutely. You can add extra payments to see how they reduce your loan duration and total interest.

Is my data saved or tracked?

No. All calculations are done locally in your browser. We respect your privacy.

How accurate are the results?

Results are based on standard amortization formulas, providing highly reliable estimates.

Can I use it on my phone?

Yes! The tool is mobile-optimized for smooth use on any device—desktop, tablet, or phone.

💡 Want to understand the basics of loans in more depth? Learn more about how loans work in this detailed guide from Investopedia.

Conclusion

Take control of your financial future with our smart, simple Loan Calculator. Whether you’re borrowing for school, a car, or a business, this tool gives you the clarity you need.

💡 Bookmark this page, share it with a friend or come back anytime you need a quick and accurate loan estimate. It’s free, fast, and always available.