Online VAT Calculator – Add or Remove VAT with Ease

VAT Amount

–

Net Price

–

Gross Price

–

Calculating VAT doesn’t have to be confusing or time-consuming. Whether you’re a freelancer, business owner, or shopper, our online VAT Calculator helps you quickly add or remove VAT from any amount. Just enter your price and VAT percentage, select whether to include or exclude VAT, and get instant results.

Forget complex formulas or guesswork — our tool delivers accurate VAT, net, and gross price breakdowns in seconds. No sign-up, no downloads, and your data stays private in your browser.

It’s fast, free, and designed for everyone — from invoicing professionals to casual users.

Start calculating now – it’s that easy!

What is VAT Calculator?

A VAT Calculator is an easy-to-use online tool that helps you calculate Value Added Tax either by adding it to a net amount or removing it from a gross price. It’s especially useful when you need to figure out how much tax is involved in a sale or purchase.

Let’s say you’re charging $100 for a service with a VAT rate of 20%:

Add VAT: $100 + 20% = $120

Remove VAT: $120 ÷ (1 + 20/100) = $100

This tool automates the math, saving you from manual errors and helping you make informed pricing decisions — whether you’re working with tax-inclusive or tax-exclusive prices.

It’s ideal for invoices, quotes, bills, or any financial record involving VAT.

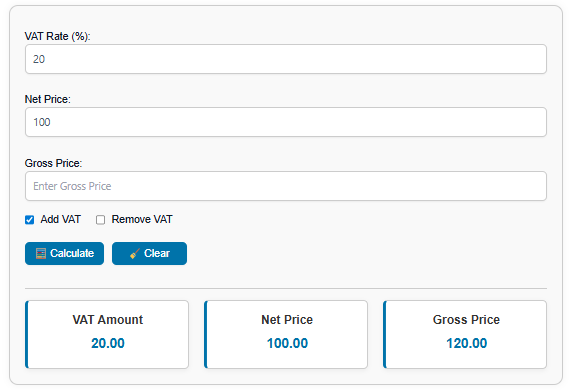

How to Use the VAT Calculator (Step-by-Step List):

Choose an action: Select “Add VAT” or “Remove VAT.”

Enter the price: Input either the Net or Gross price.

Set the VAT %: Type your applicable VAT rate (e.g., 20%).

Click “Calculate”: The tool instantly shows VAT amount, Net, and Gross values.

Optional: Click “Clear” to reset and enter new values.

Tool Features

- Add or Remove VAT Easily

Toggle between adding or removing VAT to suit your pricing scenario. Real-Time Results

Get instant, accurate calculations as you type — no waiting or reloading.Flexible Input Options

Use either VAT Rate, Net Price, or Gross Price — whatever you have available.Clear, User-Friendly Interface

Simple layout for quick use, even on mobile or tablet.100% Private & Secure

All calculations happen in your browser. We don’t store or send any of your data.

Formula & Calculation Logic

Here’s how VAT is calculated under the hood:

To Add VAT:

Gross Price = Net Price × (1 + VAT % / 100)To Remove VAT:

Net Price = Gross Price ÷ (1 + VAT % / 100)VAT Amount:

VAT = Gross – Net

📊 Example Table:

| Net Price | VAT % | VAT Amount | Gross Price |

|---|---|---|---|

| $100 | 20% | $20 | $120 |

Use Cases / Benefits

Whether you’re an e-commerce seller, freelancer, student, or business accountant, this VAT Calculator fits right into your workflow. Use it to accurately price products, double-check invoices, or understand reverse VAT scenarios.

Imagine you’re sending an invoice and unsure how much tax to include — this tool tells you in seconds. Need to remove VAT from a receipt? Done.

It’s built for real people who want clarity, not confusion.

FAQs

What is VAT and why should I calculate it?

VAT (Value Added Tax) is a type of indirect tax added to goods and services. Calculating VAT helps ensure pricing is correct and compliant with tax rules.

Can I use this calculator for any country?

Yes! Just enter the applicable VAT rate for your country — whether it’s 5%, 20%, or anything else — and the calculator will do the rest.

How do I calculate reverse VAT (from gross price)?

Select “Remove VAT,” input the VAT rate and gross price, and the tool will calculate the net and VAT amount for you.

Is my data stored or shared?

No. All calculations are done in your browser. We do not store, track, or share any information you input.

Can I use this VAT Calculator for business purposes?

Absolutely! It’s ideal for small businesses, freelancers, accountants, or anyone who handles VAT pricing and invoices.

Want to understand VAT in more detail? Learn more about VAT rules on Wikipedia.

Conclusion

No more manual VAT math or confusing formulas — our VAT Calculator is the quickest way to get accurate results instantly. Whether you’re adding or removing tax, this tool saves you time and effort.

Bookmark this page or share it with your team — and come back anytime you need reliable VAT help.